Investing

Has anyone ever told you they believe your investment success is somewhat dependent on when you were born? What if I told I think the day you were born has a bigger impact than you realize. There are several factors that lead me to believe this. One of those is because we invest for milestones in our lives. Students typically go to college when they at 18 and most people think of retirement at 65. The second one is people accumulate money on a systematic basis over many years. You start out with a little and you continue to add to it over time. Typically in greater amounts as you get closer to the goal. The challenge with this is that with traditional investment strategies: you are very dependent on the the stock markets being favorable around these milestones. What if you had planned to retire in 2000? What if your child was preparing to start college in 2009, would your investment plan for them have recovered?

My investment philosophy changed dramatically from what I was taught after the crash 2008-2009. Everything, I had been taught no longer seemed to make sense. I saw the impact that the crash had on my clients and others. While I had also been around during 2000-2002, I was a fairly new advisor, and in my opinion the principles of diversification seemed to work better during that period. Yet in 2008-09 the correlations between all equity investments seemed to tighten. What that means is that diversification of assets classes didn't really help as expected to lower downside losses.

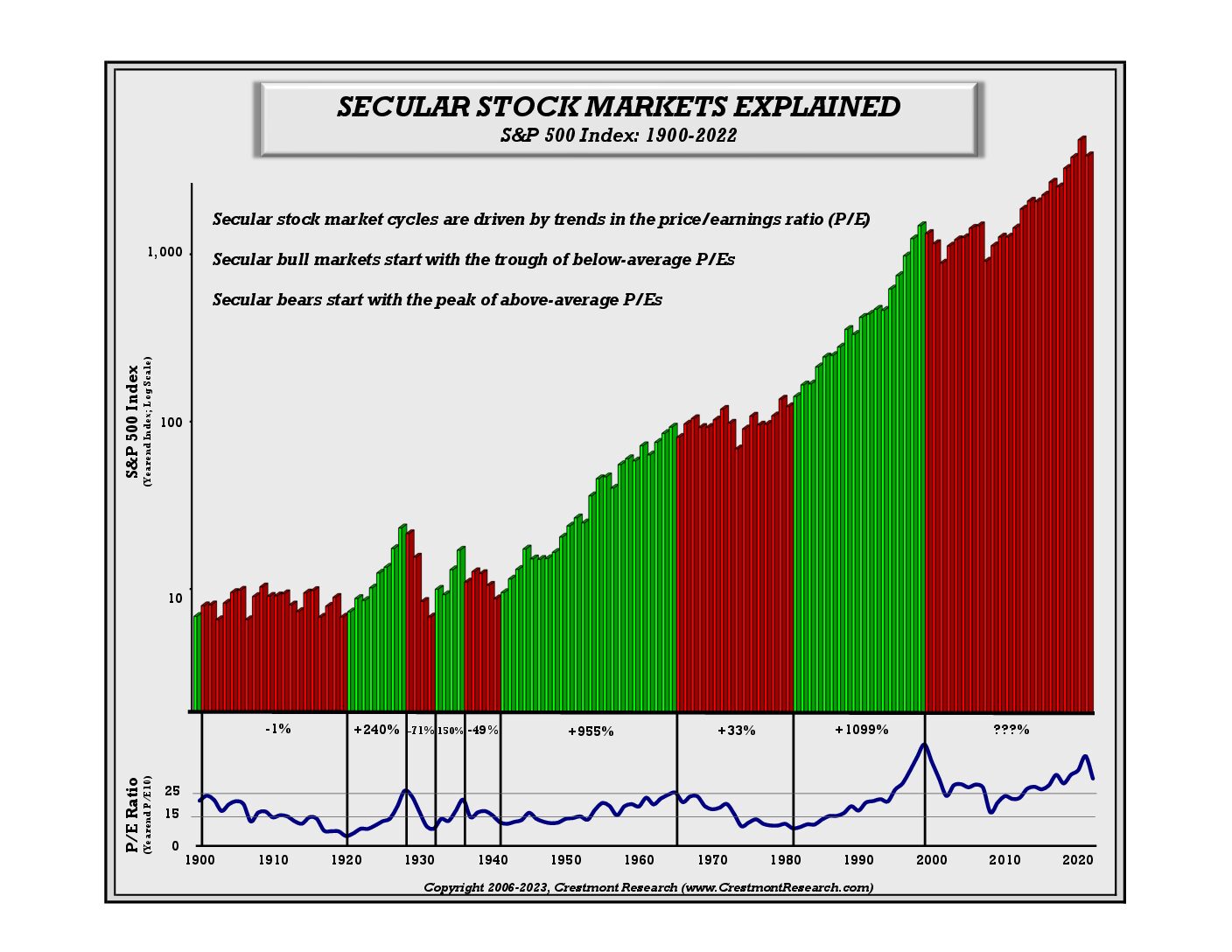

It wasn't just the market decline that changed my philosophy, but a presentation that I had seen in 2007. I had the fortune to see a presentation by Ed Easterling from Crestmont Research. At the time he spoke, I will have to admit I wasn't ready for what he was "selling". The information he shared was so different that I was unable to accept it at the time. Even today, in my opinion most advisors do not use these principals. The chart I have here comes from Crescent Research.

During the summer of 2008 I began reading the book "Unexpected Returns" by Ed Easterling. This book was given to me at the meeting I mentioned before. Why I decided to pick it up as opposed to any of the other books I owed, I don't know. As I read it, it helped me get a better understanding of how the markets cycle, and what are some of the causes. The basic concept discussed in the book is the concept of Rowing and Sailing. As you will see in the above chart, the Green areas represent times of Sailing while the Red are times to Row. During Sailing times, the market will help you achieve your returns. When it comes time to Row, you will need an investment manager that has tools to help them navigate these markets. My current process is to use both types of managers, as one never knows where the markets will go next. I feel this helps give my clients the best chance of reaching their goals. Does your current advisor use tactical managers or are you in something like the more traditional 60/ 40 stock/ bond portfolio.

7 Mistakes people make when investing

- They focus on their 1 year return and not on reaching their long term goals

- They pick last years winners to invest in

- They do not try to minimize taxes when possible

- Buy High-Sell Low vs Buy Low-Sell High because they buy with things look good and sell when things go down

- They think that taking more risk means getting higher returns

- They realize they haven't been saving enough and think that taking greater risks will help them out.

- They think they are well diversified just because they own several investments.